TTI demonstrated the resilience of its business model in 2022 in a more challenging operating environment. After nearly doubling the revenue base from 2018 to 2021, we delivered 2.8% local currency sales growth in 2022 due to the extraordinary growth of the MILWAUKEE business.

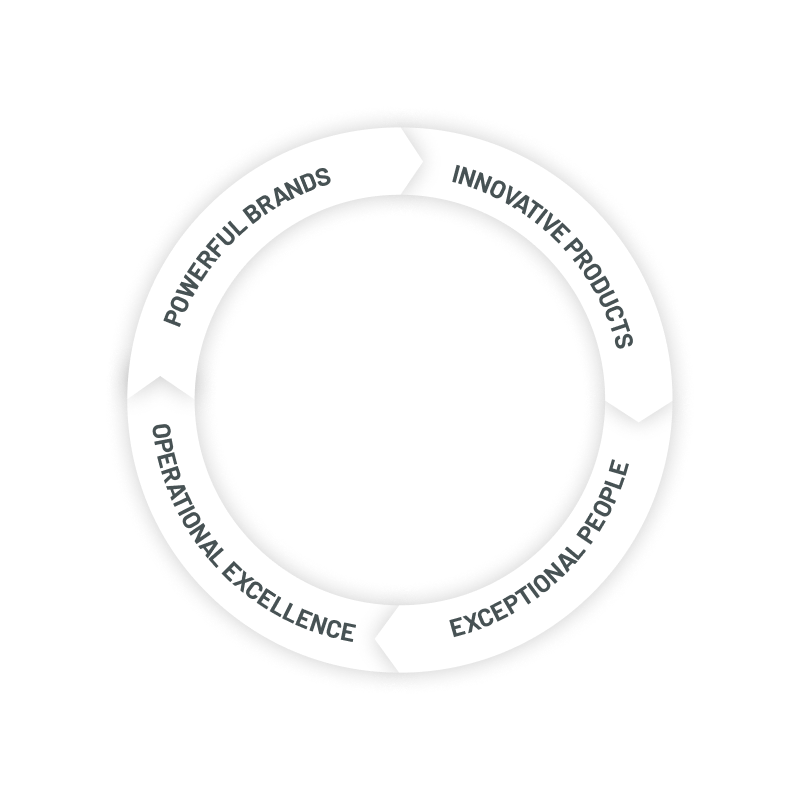

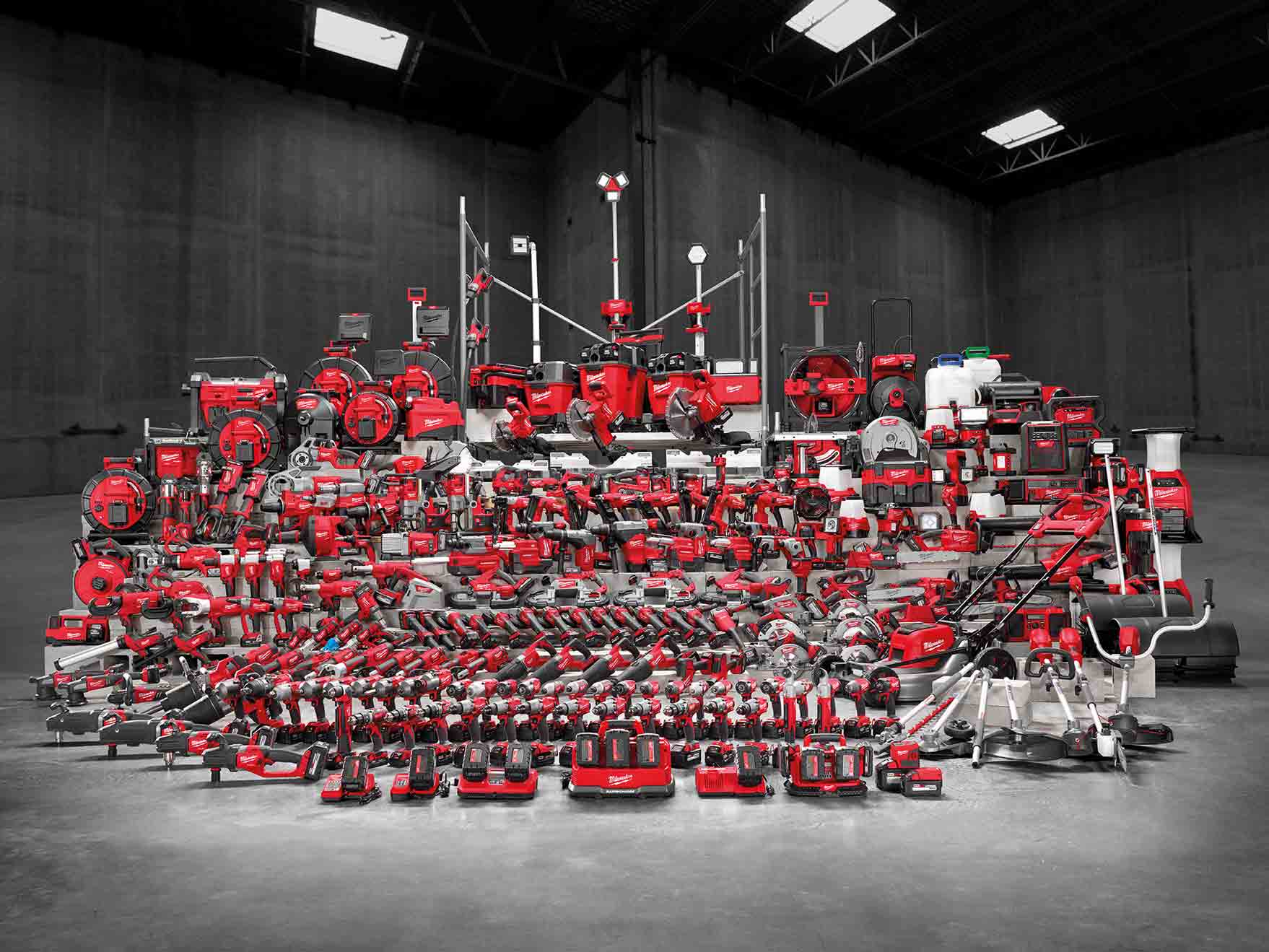

Dramatic share gains driven by our cordless market leadership, superior new product innovation, geographic expansion, and our in-field marketing initiatives propelled our industry leading performance.

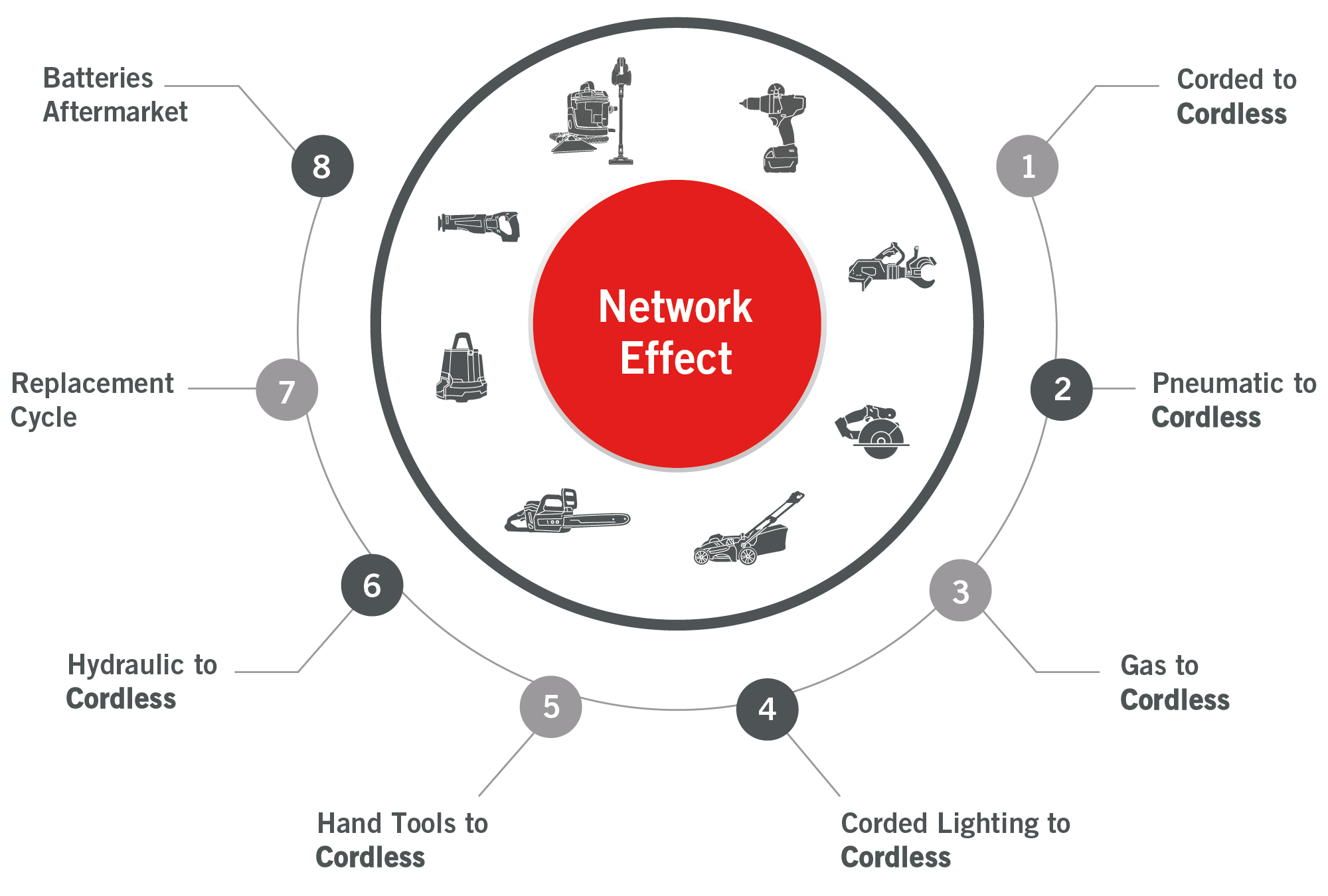

Our Power Equipment business, representing 93.0% of total sales, grew 5.5% in local currency. MILWAUKEE grew 21.8% in local currency, offsetting declines in our consumer and floorcare businesses. In our Power Equipment business, we generated low double-digit organic growth in Europe and ROW along with positive growth in our core North American business.

Gross margin improved for the 14th consecutive year, from 38.8% in 2021 to 39.3% in 2022. Mix improvement was primarily driven by the above market growth of MILWAUKEE, the success of our aftermarket battery business, margin accretive new product and manufacturing productivity. This more than compensated for margin pressure in Consumer as TTI reduced production to lower inventory levels.

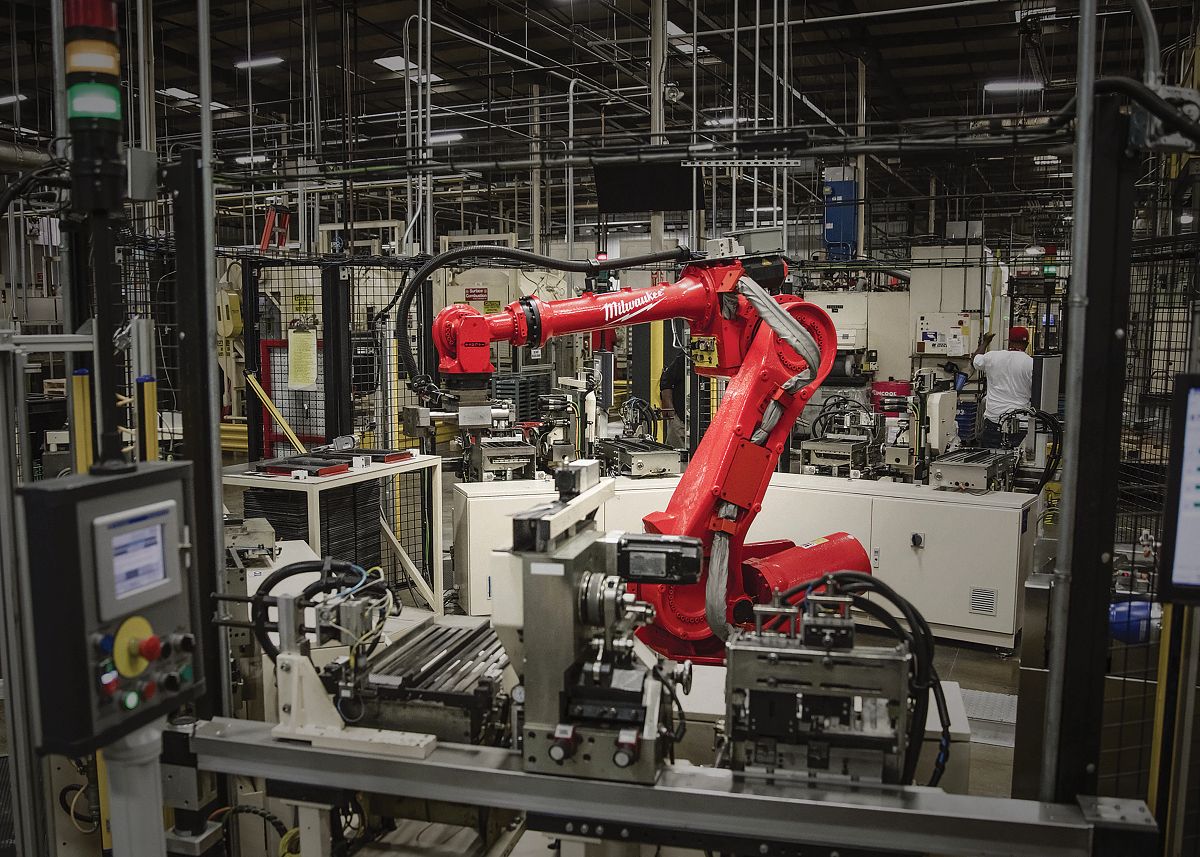

TTI continued to execute on operational excellence. For the entirety of the 2020 to 2022 time period, we maintained unparalleled customer fill rates despite widespread disruption throughout global supply chains. We have successfully diversified our manufacturing footprint into Vietnam, Mexico and the US, while maintaining our world-class facility in China. Our updated manufacturing footprint improves efficiencies, accelerates speed-to-market and maximizes flexibility.

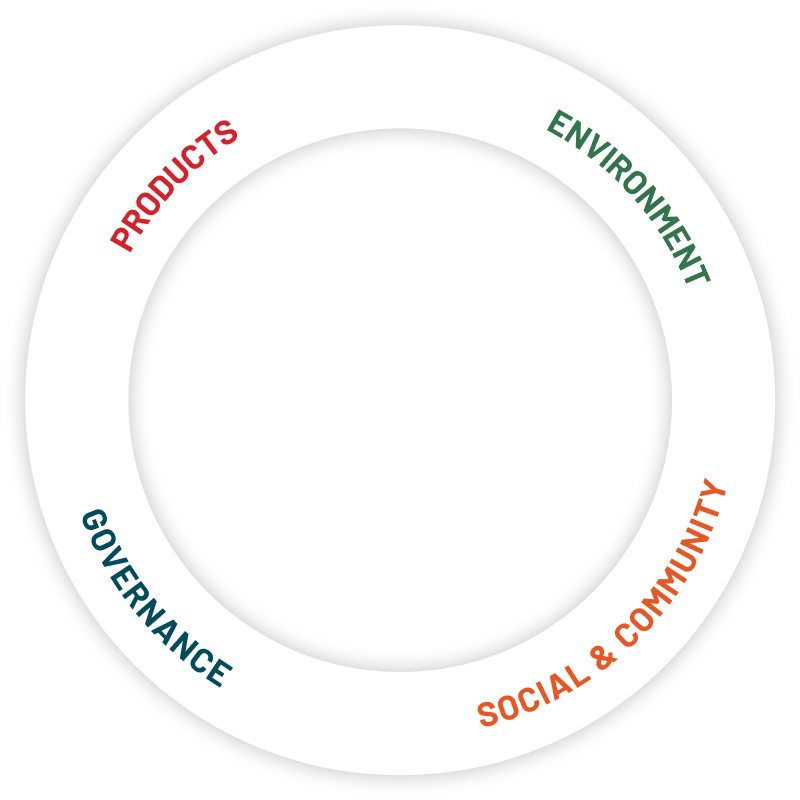

In 2022, we strengthened our leadership position in clean technology, environmental preservation, corporate accountability, and social responsibility. Significant progress was made in developing cordless products with zero emissions and noise pollution, while reducing the carbon footprint of our manufacturing processes. We also worked diligently towards reducing our absolute Scope 1 and Scope 2 Greenhouse Gas (GHG) emissions by 60% by 2030. This past year, we saw a 4% improvement in our emission intensity which resulted in a total reduction of 6,000 tonnes of CO2e emissions.

Our Power Equipment business, representing 93.0% of total sales, grew 5.5% in local currency. MILWAUKEE grew 21.8% in local currency, offsetting declines in our consumer and floorcare businesses. In our Power Equipment business, we generated low double-digit organic growth in Europe and ROW along with positive growth in our core North American business.

Gross margin improved for the 14th consecutive year, from 38.8% in 2021 to 39.3% in 2022. Mix improvement was primarily driven by the above market growth of MILWAUKEE, the success of our aftermarket battery business, margin accretive new product and manufacturing productivity. This more than compensated for margin pressure in Consumer as TTI reduced production to lower inventory levels.

TTI continued to execute on operational excellence. For the entirety of the 2020 to 2022 time period, we maintained unparalleled customer fill rates despite widespread disruption throughout global supply chains. We have successfully diversified our manufacturing footprint into Vietnam, Mexico and the US, while maintaining our world-class facility in China. Our updated manufacturing footprint improves efficiencies, accelerates speed-to-market and maximizes flexibility.

In 2022, we strengthened our leadership position in clean technology, environmental preservation, corporate accountability, and social responsibility. Significant progress was made in developing cordless products with zero emissions and noise pollution, while reducing the carbon footprint of our manufacturing processes. We also worked diligently towards reducing our absolute Scope 1 and Scope 2 Greenhouse Gas (GHG) emissions by 60% by 2030. This past year, we saw a 4% improvement in our emission intensity which resulted in a total reduction of 6,000 tonnes of CO2e emissions.

Financial Performance

TTI EBIT increased 0.8% to US$1.2 billion with margin up slightly to 9.1%. Net Profit declined 2.0% to US$1.1 billion due to higher interest expense. Earnings per share declined 2.0% to US58.86 cents.

We generated free cash flow of US$329 million, with a tremendous improvement in the second half. Working capital to sales finished the year at 21.2% compared to 20.9% a year ago. Importantly, days of finished goods inventory declined 3 days to 113 days at year end. Capital spending was reduced to US$581 million, coming off high investment levels in 2021.

The Board is recommending a final dividend of HK90.00 cents (approximately US11.58 cents) per share. Together, with the interim dividend of HK95.00 cents (approximately US12.23 cents) per share, this will result in a full-year dividend of HK185.00 cents (approximately US23.81 cents) per share, same as last year.

We generated free cash flow of US$329 million, with a tremendous improvement in the second half. Working capital to sales finished the year at 21.2% compared to 20.9% a year ago. Importantly, days of finished goods inventory declined 3 days to 113 days at year end. Capital spending was reduced to US$581 million, coming off high investment levels in 2021.

The Board is recommending a final dividend of HK90.00 cents (approximately US11.58 cents) per share. Together, with the interim dividend of HK95.00 cents (approximately US12.23 cents) per share, this will result in a full-year dividend of HK185.00 cents (approximately US23.81 cents) per share, same as last year.

Outlook

TTI is well positioned to outperform the market in 2023. We have not only right-sized our SG&A cost base, but also streamlined our fixed overhead position and prudently managed our production levels while developing a stream of innovative new products. We remain highly confident in our ability to continue driving gross margin improvement through the introduction of margin accretive new products and manufacturing productivity. With a strong increase in free cash flow and healthy balance sheet, TTI is well positioned to further expand our global cordless leadership position in the years to come.

Horst Julius Pudwill

Chairman

March 1, 2023